AI adoption in legal professions: where we stand in 2026

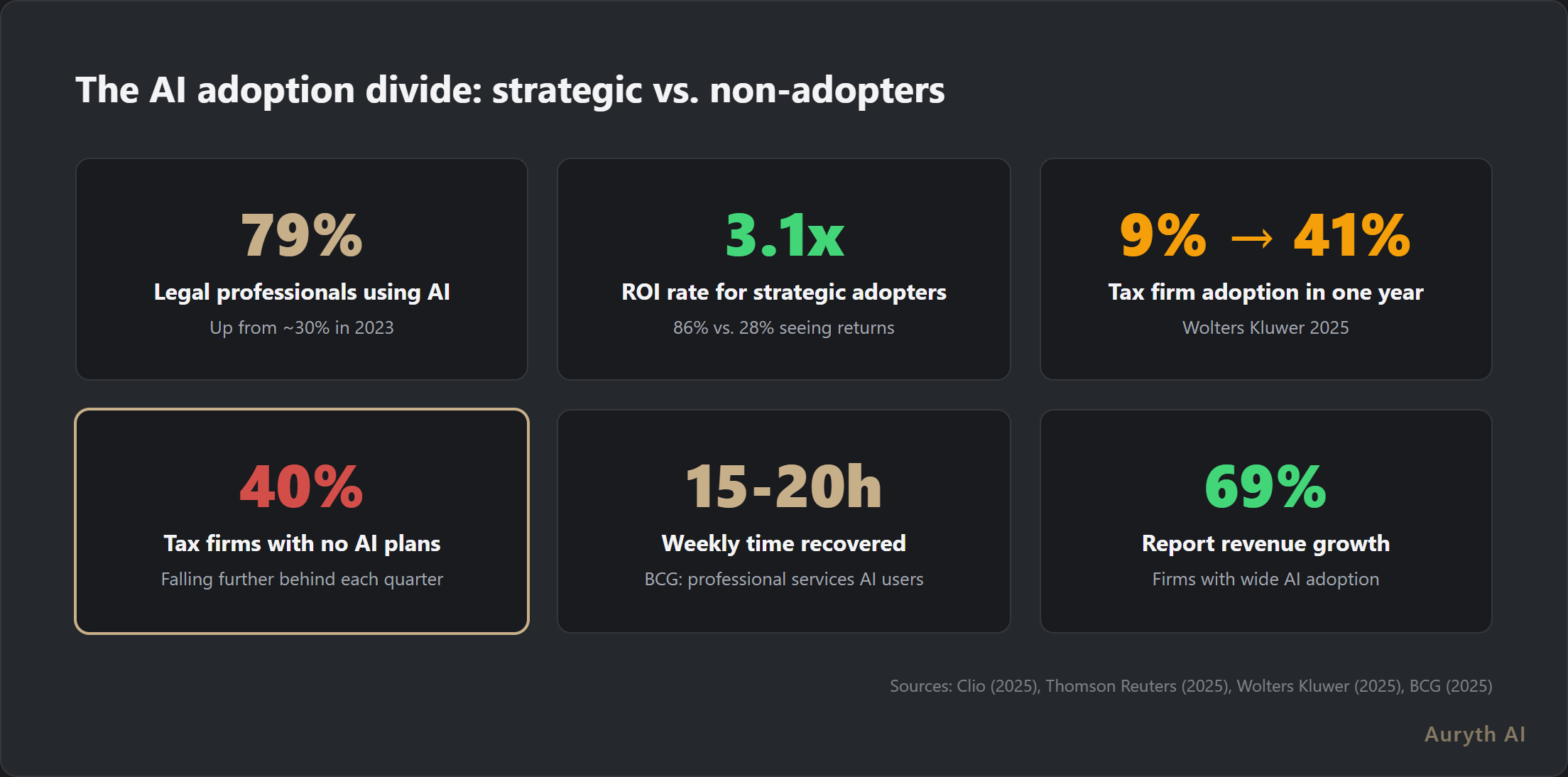

79% of legal professionals now use AI. Tax firms tripled adoption in one year. But the real story isn't the average — it's the widening gap between strategic adopters and everyone else.

By Auryth Team

In 2023, 14% of legal professionals had actively integrated AI into their workflow. By 2025, that number had nearly doubled to 26%. In tax and accounting specifically, adoption surged from 9% to 41% in a single year (Wolters Kluwer, 2025).

These are not incremental shifts. They are the kind of adoption curves that, in hindsight, mark the boundary between two eras. The question for practitioners in 2026 is no longer whether AI will transform legal and tax work. It is whether you are on the right side of the divide that is already forming.

The numbers

The data across multiple surveys converges on a consistent picture:

| Source | Key finding | Year |

|---|---|---|

| Clio Legal Trends | 79% of legal professionals now use AI; firms with wide adoption are 3x more likely to report revenue growth | 2025 |

| Thomson Reuters | Active AI integration doubled from 14% to 26% in one year; 78% expect it to become central within five years | 2025 |

| ABA Tech Survey | 31% personal use of generative AI; only 21% firm-wide adoption — the gap between individual experimentation and institutional strategy is widening | 2024 |

| Wolters Kluwer | Tax firm AI adoption tripled: 9% → 41% in one year; 79% expect significant integration by 2027 | 2025 |

| McKinsey | Professional services leads all sectors in gen AI adoption — 71% implementation rate, up from 33% in 2023 | 2024 |

The top-line numbers tell one story: rapid, broad adoption. But the more important story is in the distribution.

The divide that matters

Not all adoption is created equal. The surveys consistently reveal a structural split between firms that approach AI strategically and those that don’t:

- Firms with an AI strategy see ROI at 3.1x the rate of non-adopting peers — 86% versus 28% (Thomson Reuters, 2025)

- Firms with wide AI adoption are nearly 3x more likely to report revenue growth (Clio, 2025)

- Only 1 in 5 organizations have achieved what researchers call “AI maturity.” Two-thirds remain stuck in slow-moving proof-of-concept phases

- 40% of tax and accounting firms have no significant AI adoption plans at all (Wolters Kluwer, 2025)

This is not a bell curve where everyone gradually shifts right. It is a bimodal distribution — a growing group of strategic adopters pulling away from a shrinking but stubborn group of non-adopters. The gap between them is widening, not closing.

The ABA survey data illustrates the tension particularly well: 31% of individual lawyers use generative AI personally, but only 21% report firm-wide adoption. Personal experimentation is running ahead of institutional strategy. Professionals are curious; their organisations are cautious.

What’s driving adoption

The firms that moved first didn’t do so because they love technology. They moved because the economics became impossible to ignore:

Time recovery. BCG research found that professional service providers reclaim 15-20 hours weekly from administrative and research tasks through strategic AI use. For a tax practitioner billing at €150-300/hour, that represents €2,000-6,000 per week in recovered capacity.

Quality improvement. The same BCG data shows 20-30% enhancement in deliverable quality — not because AI writes better advice, but because it catches what humans miss: the contradictory ruling, the amended provision, the regional variation that changes the analysis.

Revenue impact. 69% of firms with wide AI adoption report positive revenue impact (Clio, 2025). Not “maybe” or “we think so” — measured, reported revenue growth directly attributed to AI-augmented practice.

Competitive pressure. When 79% of your peers are using AI and the remaining 21% are falling behind on efficiency and accuracy, the cost of non-adoption is no longer hypothetical.

What’s holding firms back

The barriers are real, and they deserve honest treatment:

| Barrier | What the data says |

|---|---|

| Accuracy concerns | 74.7% of lawyers cite accuracy as their top concern. 41% say AI needs to be 100% accurate before use without human review (ABA, 2024) |

| Data privacy | 47.2% cite data privacy and security concerns. 63% of tax firms specifically flag this as a top barrier (Wolters Kluwer, 2025) |

| Skills gaps | 53% of tax firms report significant skills gaps — they want to adopt but don’t know how (Wolters Kluwer, 2025) |

| No policy framework | 53% of legal professionals say their firm has no AI policy or are unaware of one (Clio, 2025). Only 41% of organisations have generative AI policies (Thomson Reuters, 2025) |

| ROI uncertainty | Only 20% of firms measure AI ROI at all. Hard to justify investment when you’re not tracking the return |

These barriers are legitimate — but notice the pattern. They are organizational and governance problems, not technology problems. The tools exist. What’s missing in most firms is strategy, policy, and training.

The Belgian context

European data on legal AI adoption is thinner than US data, but the signals are consistent: AI adoption by Belgian companies grew from 13.8% in 2023 to 24.7% in 2024, with further acceleration expected. Both the Flemish Bar Association (OVB) and the Dutch Bar Association (NOvA) published clear AI guidelines in 2025. The CCBE (Council of Bars and Law Societies of Europe) released its guide on generative AI for lawyers in October 2025.

The regulatory framework is settling. The professional bodies have given cautious but clear permission. The tools are becoming available. What remains is for individual firms and practitioners to make the strategic decision.

For Belgian tax professionals specifically, the adoption window carries an additional dimension. The global AI players — Harvey, Blue J, Legora — are not building for Belgium. The specialized tools that cover Belgian tax law specifically are emerging now, not in five years. The practitioners who learn to work with these tools today are building domain expertise that compounds: they learn the tool’s strengths and limitations, they develop workflows that leverage AI for the mechanical work while preserving human judgment for the complex analysis, and they build the institutional knowledge that makes the tool more effective over time.

The question is no longer whether AI will change tax practice. It is whether you will be among the firms that shaped how it changes — or among those that adapted after the fact.

Common questions

Is AI adoption in European legal professions behind the US?

Yes, but the gap is narrowing fast. The US had a head start because the major AI legal tools (Harvey, CoCounsel, Lexis+ AI) launched there first. European adoption accelerated sharply in 2025 as the EU AI Act provided regulatory clarity, professional bodies issued guidelines, and European-focused tools became available. The pattern in every technology adoption cycle: the US leads by 12-18 months, then Europe catches up rapidly.

What should a small firm do first?

Start with a policy. 53% of firms don’t have one — that alone puts you ahead of half the market. Then identify one high-frequency, time-intensive task (legal research, document summarization, initial case analysis) and test a specialized tool on that task for 30 days. Measure time saved. The data consistently shows that firms with even minimal strategy outperform those with none.

Will AI replace tax professionals?

No — but AI-augmented tax professionals will increasingly outperform those working without it. The 15-20 hours per week that strategic AI users reclaim isn’t spent idle. It’s reinvested in higher-value advisory work, deeper client relationships, and more complex problem-solving. The firms showing revenue growth aren’t cutting staff. They’re doing more with the same capacity.

Related articles

- Why Belgium is the perfect market for specialized tax AI

- “I don’t trust AI for tax advice” — and you’re right. Here’s why you should try it anyway

- The future of tax research: what AI changes, what it doesn’t

- Implementing AI in your tax practice: why trust matters more than technology

How Auryth TX applies this

Auryth TX is designed to lower the adoption barrier for Belgian tax professionals — addressing the exact concerns the survey data highlights.

On accuracy: every response includes source citations, confidence scores, and explicit flags when sources contradict. The system ranks by legal hierarchy and shows temporal validity. You verify the reasoning, not the retrieval. On privacy: the platform processes queries without storing client data. On the skills gap: the interface is built around the tax professional’s existing workflow — structured research output, not chatbot conversations.

The adoption curve is moving fast. The firms that build competence with specialized tools now will have a structural advantage that compounds with every month of experience.

The data says 79% of your peers are already using AI. The question isn’t whether to start. It’s whether to start with strategy.

Sources: 1. Clio (2025). “2025 Legal Trends Report.” Clio Legal. 2. Thomson Reuters (2025). “Future of Professionals Report 2025.” Thomson Reuters Institute. 3. Wolters Kluwer (2025). “Future Ready Accountant Report 2025.” Wolters Kluwer. 4. ABA (2025). “2024 Legal Technology Survey Report.” American Bar Association. 5. BCG (2025). “AI Radar: From Potential to Profit.” Boston Consulting Group.