Why Belgium is the perfect market for specialized tax AI

Harvey raised $760M. Blue J raised $133M. Neither can answer a question about erfbelasting in Brussels. Here's why that creates an opportunity.

By Auryth Team

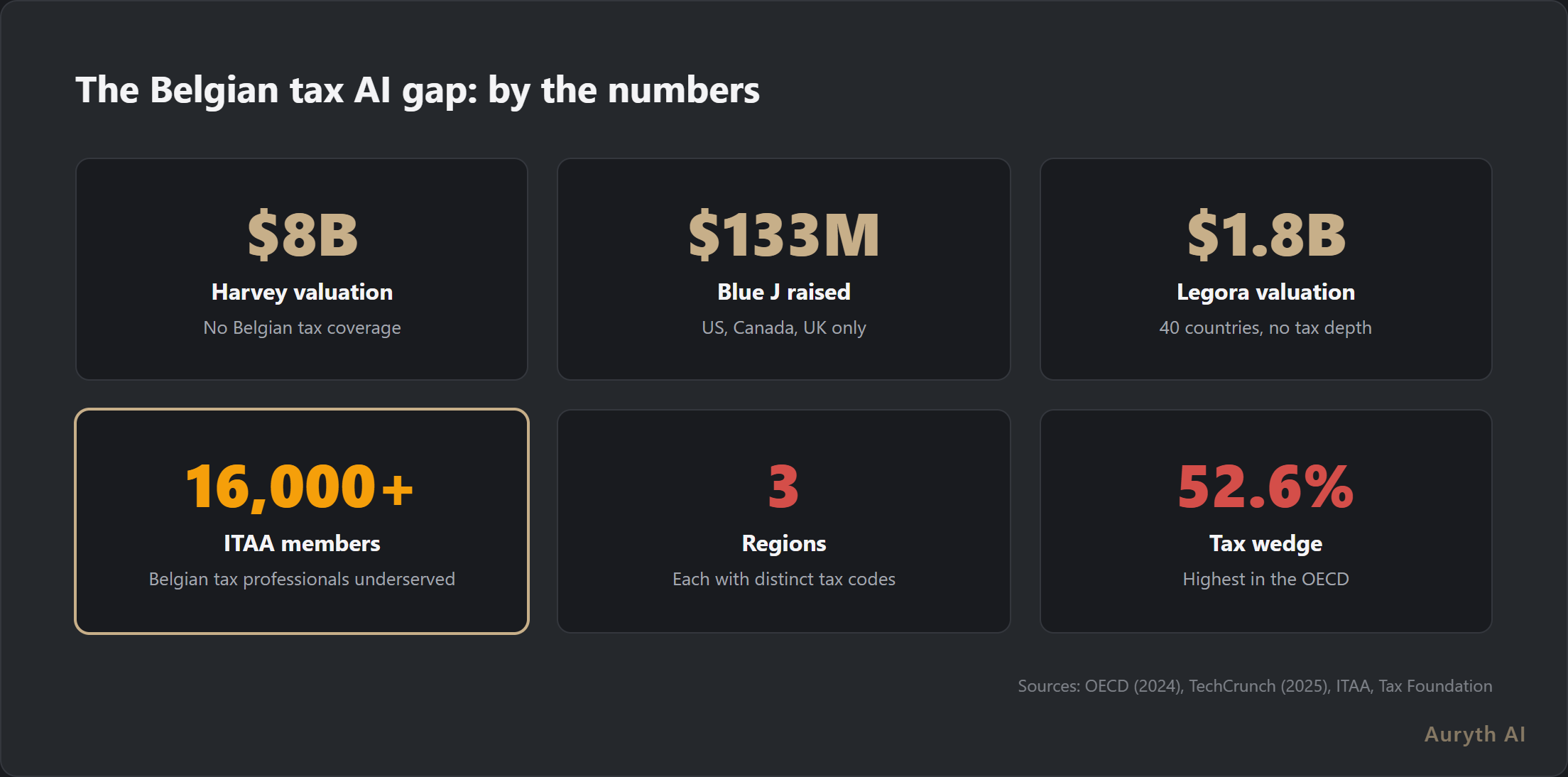

Harvey raised $760 million in 2025 alone and reached an $8 billion valuation. Blue J secured $133 million and partnered with IBFD. Legora hit $1.8 billion after expanding to 40 countries. The legal AI market is projected to reach $3.9 billion by 2030.

None of these companies can tell you whether erfbelasting in Brussels is calculated differently from Flanders. None of them cover the Vlaamse Codex Fiscaliteit. None can retrieve a ruling from the Dienst Voorafgaande Beslissingen or explain how a programme law from December 2025 changed Art. 19bis WIB 92 (Wetboek van de Inkomstenbelastingen 1992).

The conventional wisdom says Belgium is too small. Twelve thousand tax professionals. Three languages. A regulatory patchwork that would make any product manager walk away. Every investor’s first question: “Can you scale beyond Belgium?”

The counterargument is simpler than it appears: complexity, not market size, determines willingness to pay.

The complexity premium

Belgium ranks 26th out of 38 OECD countries on the International Tax Competitiveness Index — but that number understates the operational reality. The 2024 OECD Economic Survey noted that Belgium’s federal structure has “gradually but significantly evolved” through six state reforms, each pushing more tax competences to the regions.

The result is a system unlike any other in Europe:

| Dimension | What it means for tax practice |

|---|---|

| 3 regions | Flanders, Wallonia, and Brussels each have distinct inheritance tax rates, gift tax rules, registration duties, and property tax systems |

| 2 official languages | Federal legislation is published in Dutch and French. Some rulings are monolingual. Some circulars exist in one language only |

| Federal + regional overlap | Income tax is federal. Inheritance tax is regional. A single transaction can trigger both. The interaction is not always codified |

| Constant amendment | Programme laws modify dozens of provisions twice per year. A tax rate valid in January may be different by July |

| 52.6% tax wedge | Belgium has the highest tax burden on labour of all OECD countries. This complexity is not academic — it directly impacts every employment structure, every compensation package, every succession plan |

For a practitioner, this means every client question potentially spans multiple legal domains, multiple regions, and multiple temporal versions of the law. A simple question about stock options in a family company can touch federal income tax, regional gift tax, corporate tax, and potentially anti-abuse provisions — each with their own rate schedules, exceptions, and recent amendments.

This complexity is not a market obstacle. It is the market.

Why global players don’t serve Belgium

Harvey, Blue J, and Legora are building excellent products. They are not building them for Belgium. The reasons are structural:

| Global player | What they do well | Why Belgium is out of scope |

|---|---|---|

| Harvey ($8B valuation) | Enterprise legal AI for US/UK law firms; PwC tax AI partnership; 2025 revenue exceeded $100M | Belgian corpus is too small to justify the investment. PwC partnership focuses on global tax, not Belgian domestic law |

| Blue J ($133M raised) | Tax AI for US, Canada, UK; IBFD partnership for cross-border research; 90%+ outcome prediction | Coverage limited to US/CA/UK jurisdictions. IBFD partnership adds international treaty analysis, not domestic Belgian tax |

| Legora ($1.8B valuation) | European expansion across 40+ countries; general legal AI for law firms | Broad but shallow — no tax specialisation, no Belgian corpus depth, no regional comparison capability |

The pattern is clear: global players optimise for large, English-speaking jurisdictions where a single legal corpus serves millions of practitioners. Belgium’s 12,000 ITAA (Institute for Tax Advisors and Accountants) members spread across two languages and three regional tax codes will never be a priority market for a company targeting $100 million in annual revenue.

This is not a criticism. It is rational capital allocation. But it creates a gap that is large enough to build a business in.

The fragmented tooling landscape

Belgian tax professionals do not lack tools. They lack integration. The current landscape:

| Tool | What it provides | What it lacks |

|---|---|---|

| Fisconetplus | FOD Financiën’s official database — 180,000 documents in NL/FR | No AI-powered search. Keyword-only retrieval. No cross-referencing. No temporal versioning. Interface unchanged in years |

| Jura | Commercial legal database with broader coverage | Not tax-specialised. No AI layer. Subscription required for full access |

| Monkey | Tax-specific documentation, heavily used by accountants | No AI-powered search. Manual navigation. Limited cross-domain capabilities |

| Strada lex | Legal database with court decisions and doctrine | Broad legal focus, not tax-optimised. No AI integration |

A typical complex research task requires the practitioner to search across three or four of these databases, manually cross-reference results, check temporal validity, compare regional variations, and synthesise findings — all without any system verifying completeness or flagging contradictions.

The cumulative time cost is enormous. The risk of missing a relevant provision is real. And the gap between what practitioners need and what these tools provide widens every time a programme law rewrites another chapter of the tax code.

Complexity is not the enemy of product-market fit. It is the source of it. The harder the problem, the more the professional will pay for a tool that actually solves it.

Common questions

Is the Belgian market large enough to sustain a specialised tax AI platform?

The ITAA represents over 16,000 accounting and tax professionals — 12,000 certified members plus 4,000 trainees. Add notaries, corporate tax teams, and wealth managers, and the addressable market exceeds 20,000 professionals. At subscription pricing, this represents a meaningful revenue base — especially given that complexity drives higher willingness to pay and lower churn compared to simpler jurisdictions.

Won’t global players eventually add Belgian coverage?

Eventually, perhaps. But Belgian tax requires architectural decisions that global platforms have not made: bilingual corpus ingestion, regional jurisdiction tagging, authority hierarchy ranking, and temporal versioning at the article level. These are not features you bolt on — they are foundational. A global player would need to rebuild significant parts of its pipeline. By the time they do, the market will have a specialist with years of domain depth.

What about Creyten — isn’t that already Belgian tax AI?

Creyten exists and deserves credit for entering the market. But the market is at an early stage where multiple approaches can coexist. The question is not whether a Belgian tax AI tool exists — it is whether any tool yet delivers the depth that serious professionals require: structured output, authority ranking, confidence scoring, contradiction detection, temporal versioning, and regional comparison. The bar is set by the complexity of the problem, not by who entered the market first.

Related articles

- How we handle contradictory sources — and why most AI tools don’t

- The future of tax research: what AI changes, what it doesn’t, and what that means for your practice

- How to evaluate a legal AI tool: 10 questions that actually matter

- Three regions, three tax systems: why Belgian fiscal advice requires side-by-side comparison

How Auryth TX applies this

Auryth TX is built specifically for the Belgian tax landscape — the complexity that global players avoid is the problem we set out to solve.

The platform ingests the full Belgian legal corpus in both Dutch and French: federal legislation, regional codes (VCF, Brussels Wetboek, Walloon Code), administrative circulars, advance rulings, court decisions, and doctrinal commentary. Every source carries regional jurisdiction tags, temporal metadata, and a position in the legal hierarchy. A Dutch-language query automatically finds relevant French-language sources, and vice versa.

Regional comparison is native — ask one question about inheritance tax and see Flanders, Brussels, and Wallonia side by side. Temporal versioning is structural — every provision carries its effective dates, so historical questions return historical law. The architecture that makes this possible is not a feature added to a general-purpose platform. It is the foundation on which everything else is built.

Built for the complexity of Belgian tax law. By people who live inside it every day.

Sources: 1. OECD (2024). “OECD Economic Surveys: Belgium 2024.” OECD Publishing. 2. Grand View Research (2025). “Legal AI Market Size, Share & Trends.” Industry Report. 3. TechCrunch (2025). “Legal AI startup Harvey confirms $8B valuation.” December 2025. 4. Blue J & IBFD (2025). “Blue J and IBFD Unveil AI Platform for Instant Cross-Border Tax Research.” BusinessWire.