How much time does tax AI actually save? An honest estimate

Harvey users report 37 hours per month. Thomson Reuters claims 63% reduction. We looked at the real numbers for Belgian tax research — and built a conservative estimate that doesn't require you to believe marketing claims.

By Auryth Team

Every legal AI vendor has a time savings claim. Harvey power users report saving 36.9 hours per month. Thomson Reuters says CoCounsel reduces document review time by 63%. The Forrester study for LexisNexis found 2.5 hours saved per week for senior associates.

These numbers are real — they come from third-party studies and verified surveys. But they describe enterprise AI tools used by large law firms working primarily in common law jurisdictions. Belgian tax research is a different animal.

Here is what we actually know, what we can conservatively estimate, and where the honest caveats are.

What the industry data shows

The most credible studies come from independent researchers analyzing specific tools:

Forrester Total Economic Impact study (LexisNexis, May 2025): Senior partners and associates saved up to 2.5 hours per week on drafting and research. Junior associates recovered up to 35% of annual hours previously written off as non-billable. Research staff saved 225 hours annually.

RSGI/Harvey adoption report (November 2025): Power users at law firms saved 36.9 hours per month. Standard users saved 15.7 hours per month. In-house power users saved 28.3 hours per month. Two-thirds of users saw benefits within 90 days.

Everlaw innovation report (2025): Nearly half of respondents save 1-5 hours per week — equating to up to 32.5 working days per year.

Thomson Reuters CoCounsel data: 63% reduction in time spent on document review and contract drafting. Lawyers found twice as many relevant cases compared to non-AI tools. 85% reported finding more key information than manual review alone.

These numbers are impressive but they describe a different context: Anglo-Saxon legal systems, large firm workflows, English-language corpora. Belgian tax research involves three regions, two official languages, constant legislative change, and a corpus that is orders of magnitude smaller than US or UK case law.

The Belgian tax research workflow

Before estimating savings, we need to map the actual workflow. A typical cross-domain tax research task for a Belgian professional involves:

Phase 1: Identify applicable domains (15-30 minutes) Determine which federal and regional tax regimes apply to the client’s situation. For simple questions, this is obvious. For products like TAK 23 or cross-border scenarios, it requires systematic mapping.

Phase 2: Research each domain (30-90 minutes per domain) Consult Fisconetplus, Jura, or Strada lex. Read the relevant articles, check for amendments, verify effective dates. Cross-reference with circulars and administrative commentary.

Phase 3: Check for regional variations (20-60 minutes) For regionalized taxes (inheritance, gift, registration duties), compare across Flanders, Wallonia, and Brussels. Consult three different codices.

Phase 4: Verify temporal accuracy (15-30 minutes) Confirm which version of the law applies. Check for recent amendments, pending reforms, transitional provisions.

Phase 5: Synthesize and document (30-60 minutes) Combine findings into a structured analysis with sources.

Total for a complex cross-domain question: 2-5 hours.

This is not the time for a simple lookup. A quick VAT rate check takes 5 minutes with or without AI. The value of AI research is concentrated in complex, multi-domain questions — the type that involves multiple sources, multiple jurisdictions, and temporal precision.

A conservative estimate for Belgian tax research

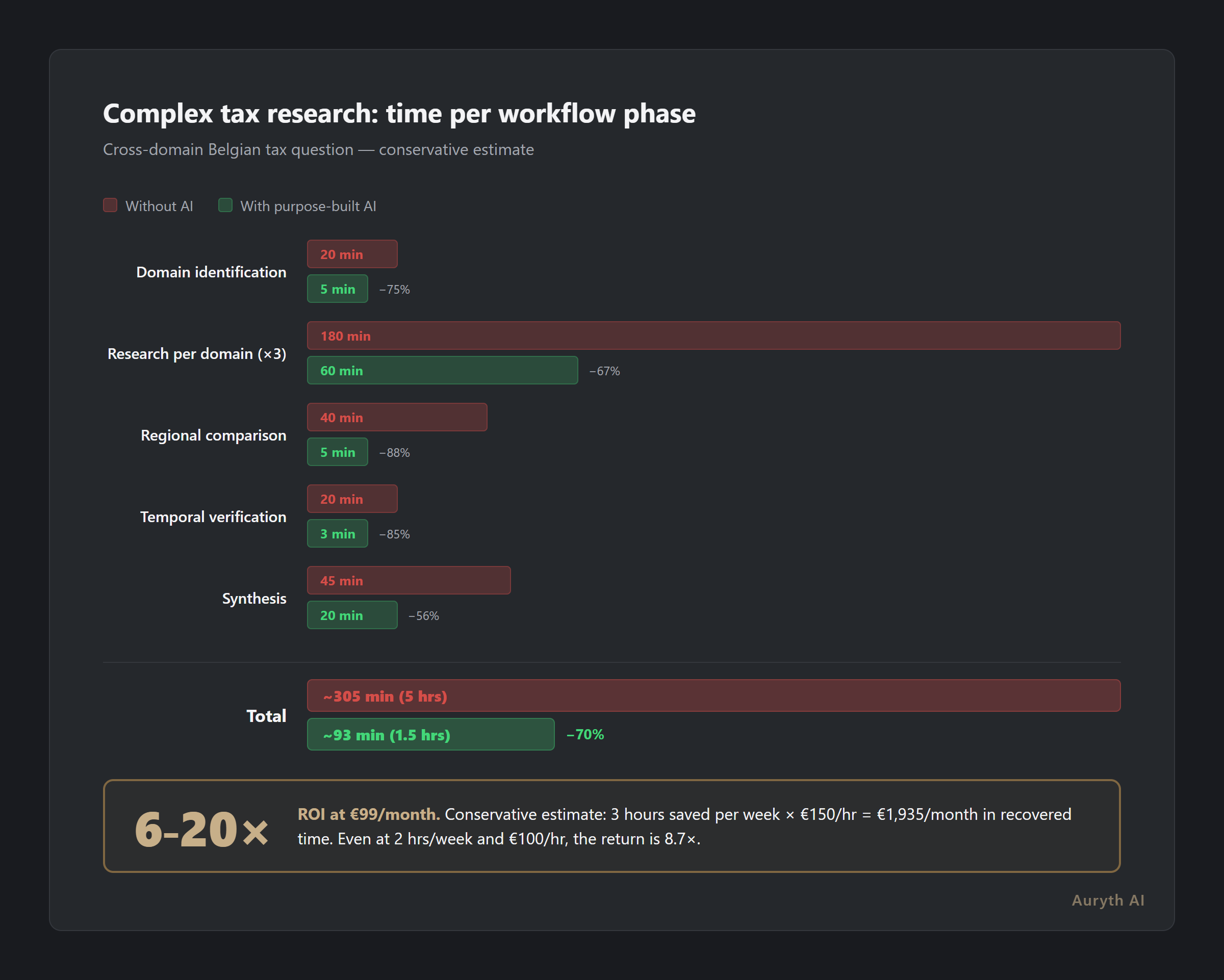

Based on the international data and the specifics of Belgian tax workflow, here is a conservative model — deliberately lower than vendor claims:

| Workflow phase | Without AI | With purpose-built AI | Saving |

|---|---|---|---|

| Domain identification | 20 min | 5 min | 15 min |

| Research per domain (×3 avg) | 60 min × 3 = 180 min | 20 min × 3 = 60 min | 120 min |

| Regional comparison | 40 min | 5 min | 35 min |

| Temporal verification | 20 min | 3 min | 17 min |

| Synthesis | 45 min | 20 min | 25 min |

| Total | ~305 min (5 hrs) | ~93 min (1.5 hrs) | ~212 min (3.5 hrs) |

This assumes a complex, multi-domain question — the type where AI adds the most value. For simpler questions, the saving is proportionally smaller. For a straightforward Fisconetplus lookup, AI may add no value at all.

Conservative weekly estimate: 1-2 complex research tasks per week × 2-3 hours saved per task = 2-6 hours saved per week.

This aligns with the lower end of the Forrester and Everlaw findings (2.5-5 hours per week), which makes sense given the smaller scale of Belgian tax practice compared to large Anglo-Saxon firms.

The ROI calculation

Belgian tax professionals bill at different rates depending on their role:

| Role | Typical hourly rate | Notes |

|---|---|---|

| Tax specialist / accountant | €65-90/hr | Based on Belgian market data |

| Lawyer (general) | €140-150/hr | Belgian average (VRT NWS, 2025) |

| Lawyer (specialized) | €175-250/hr | Complex tax, corporate advisory |

| Senior partner | €250-500+/hr | Specialized, high-value mandates |

At an average rate of €150/hour and a conservative saving of 3 hours per week:

- Monthly value of saved time: 3 hrs × 4.3 weeks × €150 = €1,935/month

- Against a subscription of €99-299/month: ROI of 6-20x

Even at the conservative end — 2 hours saved per week at €100/hour — the monthly value is €860. Against a €99 subscription, that is still an 8.7x return.

The math works not because the savings are spectacular, but because the cost is low relative to professional billing rates. One complex dossier per week handled faster pays for the tool several times over.

What the numbers don’t capture

The most significant benefits of AI-assisted tax research are not time savings at all:

Broader coverage. Thomson Reuters found that lawyers discovered twice as many relevant cases with AI tools compared to manual research. In Belgian tax, this means catching the Art. 19bis interaction you did not think to look for, or the regional inheritance tax variation you would have missed.

The CoCounsel study found that 85% of users discovered information they would not have found through manual review alone. For a multi-domain product like TAK 23 — where most advisors cover 3 of 7 applicable tax domains — this is potentially more valuable than any time saving.

Change monitoring. Belgian tax law changes at least twice per year through program laws, plus ad-hoc amendments throughout the year. Manually tracking which provisions have been amended since your last research is a structural gap in traditional workflow. An AI system with temporal versioning can flag when a source you relied on has been superseded.

Audit trail. The EU AI Act (August 2026) and OVB guidelines increasingly require demonstrable research trails. An AI system that structures its output with sources, confidence levels, and version metadata creates this trail automatically. Building it manually adds 15-30 minutes per dossier.

Risk reduction. Inadequate legal research is a documented basis for professional malpractice claims. While specific data linking research thoroughness to claim frequency is limited, the principle is clear: broader, more systematic research reduces the probability of missing a critical provision.

The honest caveats

Not every task benefits from AI research. Here is where the tool adds little or no value:

- Simple lookups. Checking the current corporate tax rate or a BTW percentage takes 30 seconds in Fisconetplus. AI does not make that faster.

- Well-known terrain. If you specialize in inheritance tax in Flanders and know the VCF inside out, the AI’s research is confirming what you already know.

- First-principles analysis. AI retrieves and organizes — it does not replace the professional judgment needed to advise a client on the optimal structure for their specific situation.

- Emerging areas with thin corpus. Where Belgian case law or administrative guidance is sparse (e.g., crypto taxation in its early days), the AI has limited material to retrieve.

The value concentrates in complex, cross-domain questions where multiple sources, jurisdictions, and time periods intersect — and where the risk of missing something is highest.

What to actually measure

If you are evaluating a legal AI tool for your practice, measure these three things during a trial:

- Time per complex dossier. Pick three representative complex research tasks. Time yourself without the tool, then with it. The difference is your baseline saving.

- Coverage delta. After completing a task without the tool, run it through the tool and note any additional domains, provisions, or variations the tool flagged that you did not. This is the coverage value.

- Confidence level. Rate your confidence in the completeness of your research on a 1-10 scale, with and without the tool. The delta here correlates with risk reduction.

The time saving is the easiest to quantify, but the coverage delta is where the real value often sits — particularly for Belgian tax, where the structural complexity (three regions, constant change, cross-domain interactions) means that every complex question has blind spots.

Related articles

- How to evaluate a legal AI tool: 10 questions that actually matter →

- “I don’t trust AI for tax advice” — and you’re right. Here’s why you should try it anyway. →

- Three regions, three tax systems: why Belgian fiscal advice requires side-by-side comparison →

How Auryth TX applies this

Auryth TX is priced at €99/month for individual professionals — a fraction of the €1,200+/month that enterprise tools like Harvey charge. The math is simple: if the tool saves you one hour per week on complex research, it pays for itself 6-15 times over, depending on your billing rate.

But we designed the tool to maximize the coverage benefit, not just the speed benefit. When you ask a question, the domain radar maps every applicable tax regime automatically. The regional comparison presents all three regions side by side. The temporal versioning ensures you get the law as it stands for your client’s specific period.

The result: not just faster research, but more complete research — with an audit trail that documents every source, every confidence level, and every version of every provision cited.

€99/month. One complex dossier per week handled faster. The ROI speaks for itself.

Sources: 1. Forrester (2025). “Total Economic Impact of Lexis+ AI for Large Law Firms.” Commissioned by LexisNexis. 2. RSGI/Harvey (2025). “The Impact of Legal AI: Adoption Report.” Legal Intelligence Group. 3. Everlaw (2025). “Ediscovery Innovation Report.” In partnership with ACEDS and ILTA. 4. Thomson Reuters/Maryland State Bar. “Navigating Legal AI: CoCounsel.” msba.org. 5. VRT NWS (2025). “Hoeveel kost een advocaat?” vrt.be. 6. McKinsey (2025). “Agents, Robots, and Us: Skill Partnerships in the Age of AI.”