Harvey, Blue J, Legora: what we can learn from the big players in legal AI

$8 billion. $1.8 billion. $133 million. The world's best-funded legal AI companies are proving the model works. They're also proving what it can't do for Belgian tax.

By Auryth Team

Harvey reached an $8 billion valuation and serves 100,000 lawyers across 60 countries. Blue J raised $133 million and predicts tax outcomes with 90%+ accuracy across three jurisdictions. Legora hit $1.8 billion after expanding to 40+ countries in under a year.

These are not competitors to dismiss. They are proof points. They validate that legal professionals will pay meaningful subscription fees for AI tools that save time, improve quality, and reduce risk. They prove the model works. And they reveal, through their architecture choices and market focus, exactly where the gaps remain.

This article examines what each does well, where each falls short for Belgian practice, and what the patterns tell us about building specialized legal AI.

Harvey: the enterprise juggernaut

What they’ve built. Harvey is the dominant player in legal AI, backed by over $1 billion in total funding. Their capabilities span document analysis, contract review, legal research, and now tax — through a strategic partnership with PwC. In independent benchmarks (VLAIR, February 2025), Harvey scored highest in 5 out of 6 tasks, including 94.8% accuracy on document Q&A. They serve Allen & Overy, HSBC, WongPartnership, and hundreds of other major firms.

What they do well:

- Scale. 100,000+ lawyers in 1,000+ organizations across 60 countries

- Enterprise integration. The Aderant partnership (December 2025) connects AI-powered work to billing systems

- Benchmarking transparency. Harvey published BigLaw Bench and the Contract Intelligence Benchmark — open datasets for evaluating legal AI. This is unusual and commendable

- PwC tax partnership. Gives Harvey a credible entry into global tax advisory

Where it falls short for Belgian practice:

- PwC Belgium offers Harvey solutions, but the underlying model isn’t built for Belgian tax law. It’s a global tax tool applied to Belgium, not a Belgian tax tool

- No coverage of the Vlaamse Codex Fiscaliteit, Brussels or Walloon regional codes, or the specific interplay between federal and regional taxation

- No bilingual corpus (NL/FR) with cross-language search

- Enterprise pricing only. Industry estimates put the cost at ~$1,200 per seat per year, with custom negotiation for each deal. That model serves Am Law 100 firms. It doesn’t serve a solo Belgian tax practitioner

Blue J: the tax specialist

What they’ve built. Blue J is the only major player built specifically for tax. Their prediction engine claims 90%+ accuracy for tax outcome prediction — not just research retrieval, but probabilistic assessment of how a court would likely rule. The IBFD partnership (September 2025) extends their reach to cross-border tax research covering 220+ jurisdictions.

What they do well:

- Tax-specific architecture. Unlike general legal AI tools, Blue J was built from the ground up for tax law

- Prediction capability. Outcome prediction at 90%+ accuracy is a genuinely differentiated feature that no other major player replicates

- IBFD partnership. Access to the world’s largest collection of international tax treaties and commentary

- Serving multiple firm sizes. Unlike Harvey’s enterprise-only model, Blue J serves Big 4 firms, mid-market, and solo practitioners

Where it falls short for Belgian practice:

- Coverage limited to US, Canada, and UK jurisdictions. The IBFD partnership adds international treaty analysis, but not Belgian domestic law

- No coverage of Belgian federal or regional tax codes

- No ruling retrieval from the Dienst Voorafgaande Beslissingen (Belgian advance tax ruling commission)

- No temporal versioning for Belgian law changes

- The IBFD extension targets cross-border research, not domestic Belgian tax practice — which is where the majority of daily work happens

Legora: the European expansionist

What they’ve built. Founded in Stockholm, Legora raised $226 million total and expanded from 20 to 40+ countries in five months. They serve 400+ customers including Linklaters, Cleary Gottlieb, White & Case, and Bird & Bird. Average annual contract: ~$280,000 per customer.

What they do well:

- European DNA. Stockholm headquarters, London office, genuine European legal tradition

- Rapid jurisdictional expansion. The ability to add 20+ countries in months suggests a scalable architecture for multi-jurisdictional coverage

- Tax as a growing vertical. Legora explicitly positions tax as a key specialization area — transfer pricing documentation, tax risk assessment from data rooms, cross-jurisdictional consistency

- Major law firm adoption. When Linklaters and Cleary Gottlieb use your product, the validation is real

Where it falls short for Belgian practice:

- Breadth over depth. 40+ countries with 400 customers means approximately 10 customers per country — that’s thin coverage by any measure

- No evidence of deep Belgian tax corpus ingestion

- No regional comparison capability (Flanders vs. Brussels vs. Wallonia)

- Pricing model targets large law firms ($280,000 average annual contract). Belgian mid-market firms and solo practitioners are priced out

- General legal AI with tax features, not tax AI with legal context. The distinction matters when you need to trace how Art. 19bis WIB 92 interacts with the Vlaamse Codex Fiscaliteit

The pattern

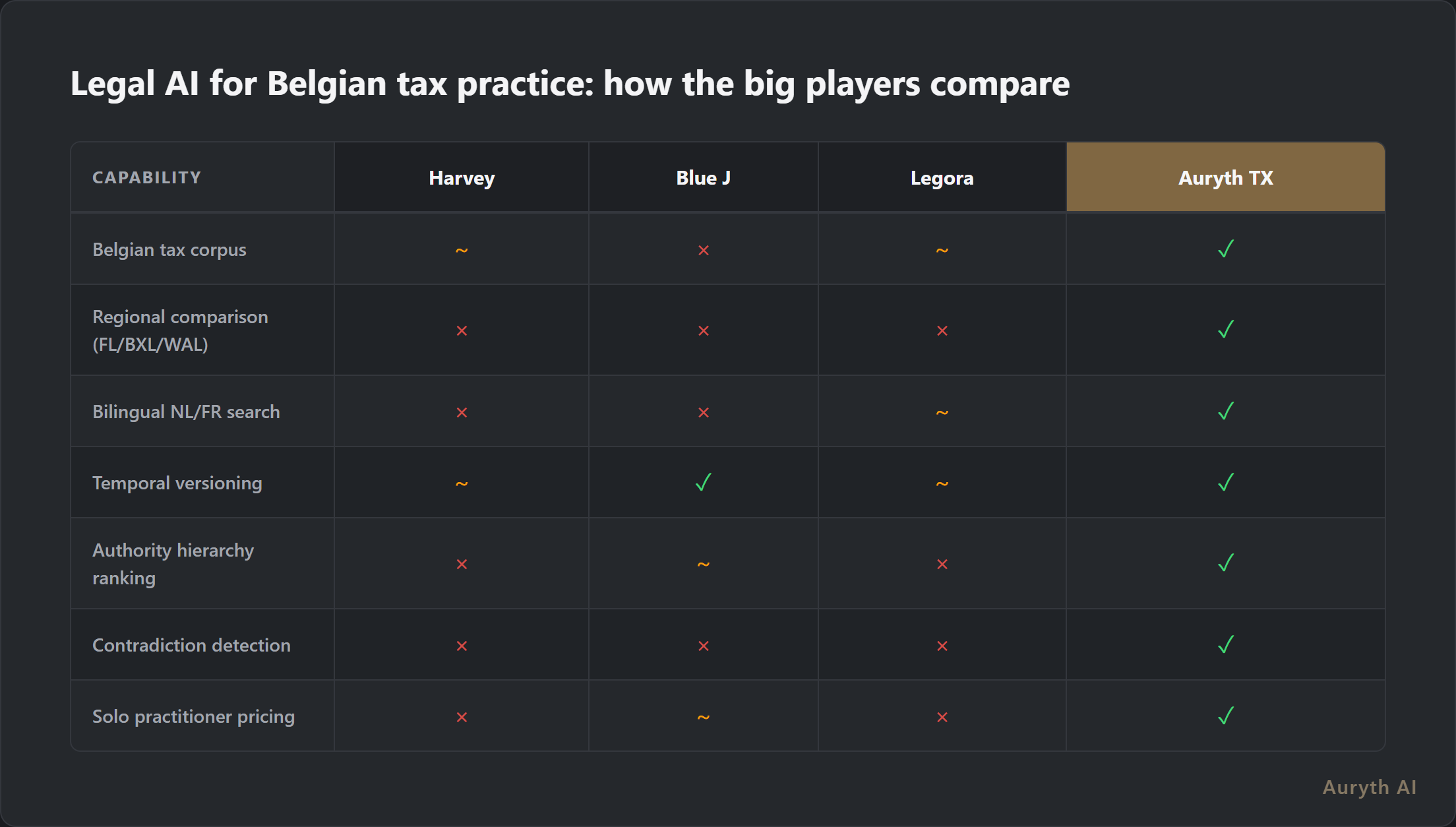

| Dimension | Harvey | Blue J | Legora | What Belgian practice needs |

|---|---|---|---|---|

| Tax depth | Global tax via PwC | US/CA/UK domestic tax | Tax as one vertical | Belgian federal + 3 regional codes |

| Jurisdictions | 60 countries (broad) | 3 countries (deep) | 40+ countries (scaling) | Belgium-specific with regional granularity |

| Language | English-primary | English-only | Multi-language (limited) | NL/FR bilingual with cross-language search |

| Pricing | ~$1,200/seat enterprise | Custom enterprise | ~$280K/year per firm | Accessible to solo practitioners |

| Transparency | Benchmarks published | Prediction accuracy published | No public benchmarks | Source citations + confidence scores + contradiction flags |

| Belgian coverage | Via PwC (indirect) | None | Unclear | Full corpus: legislation, circulars, rulings, case law, doctrine |

Three patterns emerge:

1. Big markets get served; small complex markets don’t. Harvey optimizes for the US and UK. Blue J serves the US, Canada, and UK. Legora expands fast but thin. Belgium’s 12,000+ ITAA members across two languages and three regional tax codes will never be a priority market for companies targeting $100M+ annual revenue.

2. General-purpose and deep specialization are different architectures. Harvey and Legora build horizontal platforms that can theoretically cover any jurisdiction. Blue J builds deep vertical capability for specific tax domains. The Belgian tax system — with its federal-regional overlap, bilingual corpus, and constant legislative changes — requires the deep approach, not the horizontal one.

3. Transparency is the exception, not the norm. Harvey deserves credit for publishing benchmarks. Blue J publishes prediction accuracy. But none of these tools systematically surface source contradictions, rank by legal hierarchy, or flag when the administrative position diverges from case law. For Belgian tax practitioners who need to navigate genuinely ambiguous positions, this gap is material.

The biggest validation from Harvey, Blue J, and Legora isn’t their technology — it’s their revenue. Legal professionals will pay for AI that saves time and reduces risk. The question is whether anyone is building it for Belgian tax specifically.

The Belgian landscape

Two Belgian players deserve mention:

Creyten is a joint venture between a boutique tax law firm (Animo Law) and a data consultancy (Acumen). They focus on Belgian tax specifically — covering legislation, tax treaties, administrative positions, advance rulings, and case law. They allow users to upload proprietary documents. They are the closest existing tool to what Belgian tax practice actually requires.

LegalFly, based in Ghent, raised €15 million in Series A (2024) and focuses on automating repetitive legal tasks with strong data security (on-premise anonymization). Their focus is broader legal work, not tax-specific.

Alice, also from Ghent, raised €1 million in pre-seed (January 2026) for verifiable AI workflows in litigation. They already serve 60+ Belgian law firms and plan expansion to the Netherlands and France.

The Belgian legal AI market is early-stage but emerging fast. The question for each player — including Auryth — is whether they can build the depth that Belgian tax complexity demands before the global players eventually turn their attention this way.

Common questions

Is Harvey really that expensive?

For a solo Belgian tax practitioner, yes. Harvey’s enterprise pricing model requires custom negotiation, and industry estimates place the cost at roughly $1,200 per seat per year — with minimums that effectively exclude small firms. The platform was designed for Am Law 100 firms and Big 4 advisory practices, not for a two-person Belgian tax office.

Will Blue J expand to Belgian tax law?

Not in the foreseeable future. The IBFD partnership adds international treaty analysis, but Belgian domestic tax law requires architectural decisions Blue J hasn’t made: bilingual corpus ingestion, regional jurisdiction tagging, and temporal versioning at the article level. These are foundational choices, not features to add later.

Should I be using one of these tools now?

If your practice involves cross-border tax work with US, Canadian, or UK elements, Blue J via the IBFD partnership may add value when it reaches general availability (expected Q1 2026). For domestic Belgian tax practice — which is the majority of most Belgian practitioners’ work — these global tools don’t yet serve the need.

Related articles

- Why Belgium is the perfect market for specialized tax AI

- AI adoption in legal professions: where we stand in 2026

- How to evaluate a legal AI tool: 10 questions that actually matter

- The future of tax research: what AI changes, what it doesn’t

How Auryth TX applies this

Auryth TX occupies the position that none of the global players target: deep, specialized Belgian tax AI accessible to individual practitioners.

The platform ingests the full Belgian legal corpus in both Dutch and French — federal legislation, regional codes (VCF, Brussels code, Walloon code), administrative circulars, advance rulings, case law, and doctrinal commentary. Every source carries regional jurisdiction tags, temporal metadata, and a position in the legal hierarchy. A Dutch-language query automatically finds relevant French-language sources, and vice versa.

Regional comparison is native — ask one question about erfbelasting and see Flanders, Brussels, and Wallonia side by side. Temporal versioning is structural — every provision carries its effective dates. Source contradictions are flagged, not hidden. Confidence scores drop when sources disagree.

This isn’t the architecture that Harvey, Blue J, or Legora would build. It’s the architecture that Belgian tax practice requires.

What the global players validate: legal AI works and professionals will pay for it. What they don’t build: the depth that Belgian tax complexity demands.

Sources: 1. Vals AI (2025). “VLAIR Industry Benchmark Report.” February 2025. 2. Blue J & IBFD (2025). “Blue J and IBFD Unveil AI Platform for Instant Cross-Border Tax Research.” BusinessWire. 3. Legora (2025). “Legora raises $150 million Series C.” October 2025. 4. TechCrunch (2025). “Legal AI startup Harvey confirms $8B valuation.” December 2025. 5. LegalFly (2024). “LegalFly secures €15 Million.” July 2024.