Case study: estate planning across three regions — one family, three tax outcomes

A couple in Antwerp with €2M in assets. Two children in different regions. Three inheritance tax regimes. Here's how the numbers diverge — and what a complete advisory analysis actually looks like.

By Auryth Team

Marc and Sofie De Smet are both 63, married under community property, and live in Antwerp. Their combined estate is worth roughly €2 million. They want to start planning. Their notary asks which region’s rates apply. Their accountant asks about the new Flemish reform. Their daughter in Brussels asks whether she should worry about Brussels rates instead. Their son in Ghent asks whether a gift now would be smarter than an inheritance later.

Four people. Four questions. Three tax regimes. Zero single answers.

This is not an unusually complex situation. This is what Belgian estate planning looks like for any family with assets above €500,000.

The family profile

| Detail | Value |

|---|---|

| Couple | Marc (63) & Sofie (63), married under community property |

| Tax residence | Antwerp (Flanders) — lived there 20+ years |

| Family home | Antwerp, estimated value €650,000 |

| Vacation property | Apartment in Namur province (Wallonia), €250,000 |

| Investment portfolio | Securities and funds, €800,000 |

| Savings and other movable | €300,000 |

| Total estate | ~€2,000,000 |

| Children | Lisa (35, lives in Brussels) and Thomas (32, lives in Ghent) |

The key question: if Marc dies first, what does the tax picture look like — and what can they do now to optimize it?

Which region applies?

Belgian inheritance tax (erfbelasting / droits de succession) is a regional competence. The applicable region is determined by where the deceased lived the longest during the last five years before death (Art. 2, §1, 5° Vlaamse Codex Fiscaliteit; Art. 1 Wetboek Successierechten).

Marc has lived in Antwerp for over 20 years. Flemish rates apply — regardless of where his children live and regardless of where the vacation property is located.

The children’s region of residence does not determine the tax rate. The deceased’s last fiscal domicile does. This is one of the most common misconceptions in Belgian estate planning.

This means Lisa in Brussels pays Flemish inheritance tax rates on her share of Marc’s estate — not Brussels rates. The same applies to Thomas in Ghent.

The baseline: what happens without planning

Under Belgian intestacy rules with community property, Sofie receives the usufruct of the entire estate. Lisa and Thomas receive the bare ownership in equal shares. But for inheritance tax purposes, the calculation depends on the value of what each heir receives.

Simplified scenario: Marc’s estate (his half of the community property) = €1,000,000.

Flemish rates (2026, post-reform)

Flanders reformed its inheritance tax effective January 1, 2026 under the Vlaamse Codex Fiscaliteit. The key rates for direct-line heirs:

| Bracket | Rate |

|---|---|

| €0–€50,000 | 0% (tax-free) |

| €50,001–€150,000 | 3% |

| €150,001–€250,000 | 9% |

| €250,001+ | 27% |

Key exemptions (Flanders 2026):

- Family home: fully exempt for surviving spouse or legal cohabitant

- Partner exemption on movable assets: €75,000 (increased from €50,000 on January 1, 2026)

- Base exemption: €12,500 per heir

Calculating Sofie’s tax (surviving spouse, Flanders)

Sofie inherits the usufruct of Marc’s €1,000,000 estate. The taxable usufruct value is calculated using the conversion table based on Sofie’s age (63).

But the critical exemptions change the picture dramatically:

- Family home (€325,000 — Marc’s half): fully exempt

- Partner exemption: €75,000 exempt on movable assets

- Base exemption: €12,500

After exemptions, Sofie’s taxable base is significantly reduced. Estimated tax: €40,000–€55,000 depending on the exact usufruct valuation.

What if Marc had lived in Wallonia instead?

Now imagine the same family, same assets — but Marc’s fiscal domicile is in Namur (Wallonia).

Walloon rates (current, pre-2028 reform):

| Bracket | Rate |

|---|---|

| €0–€12,500 | 3% |

| €12,501–€25,000 | 4% |

| €25,001–€50,000 | 5% |

| €50,001–€100,000 | 7% |

| €100,001–€150,000 | 10% |

| €150,001–€200,000 | 14% |

| €200,001–€250,000 | 18% |

| €250,001–€500,000 | 24% |

| €500,001+ | 30% |

The maximum rate is 30% — versus Flanders’ 27%. But more significantly, Wallonia’s exemptions are less generous:

- Family home: exempt for surviving spouse, but subject to a 5-year residence requirement (eliminated in the 2028 reform)

- Base exemption: €12,500 (€25,000 if net share ≤ €125,000)

- No equivalent of Flanders’ €75,000 partner exemption on movable assets

Estimated tax for the same estate in Wallonia: €75,000–€95,000 for the surviving spouse alone.

And if he had lived in Brussels?

Brussels rates (2026):

| Bracket | Rate |

|---|---|

| €0–€50,000 | 3% |

| €50,001–€100,000 | 8% |

| €100,001–€175,000 | 9% |

| €175,001–€250,000 | 18% |

| €250,001–€500,000 | 24% |

| €500,001+ | 30% |

Brussels offers a family home abattement up to €250,000 for direct heirs and surviving spouse — but not a full exemption like Flanders.

Estimated tax for the same estate in Brussels: €65,000–€85,000 for the surviving spouse.

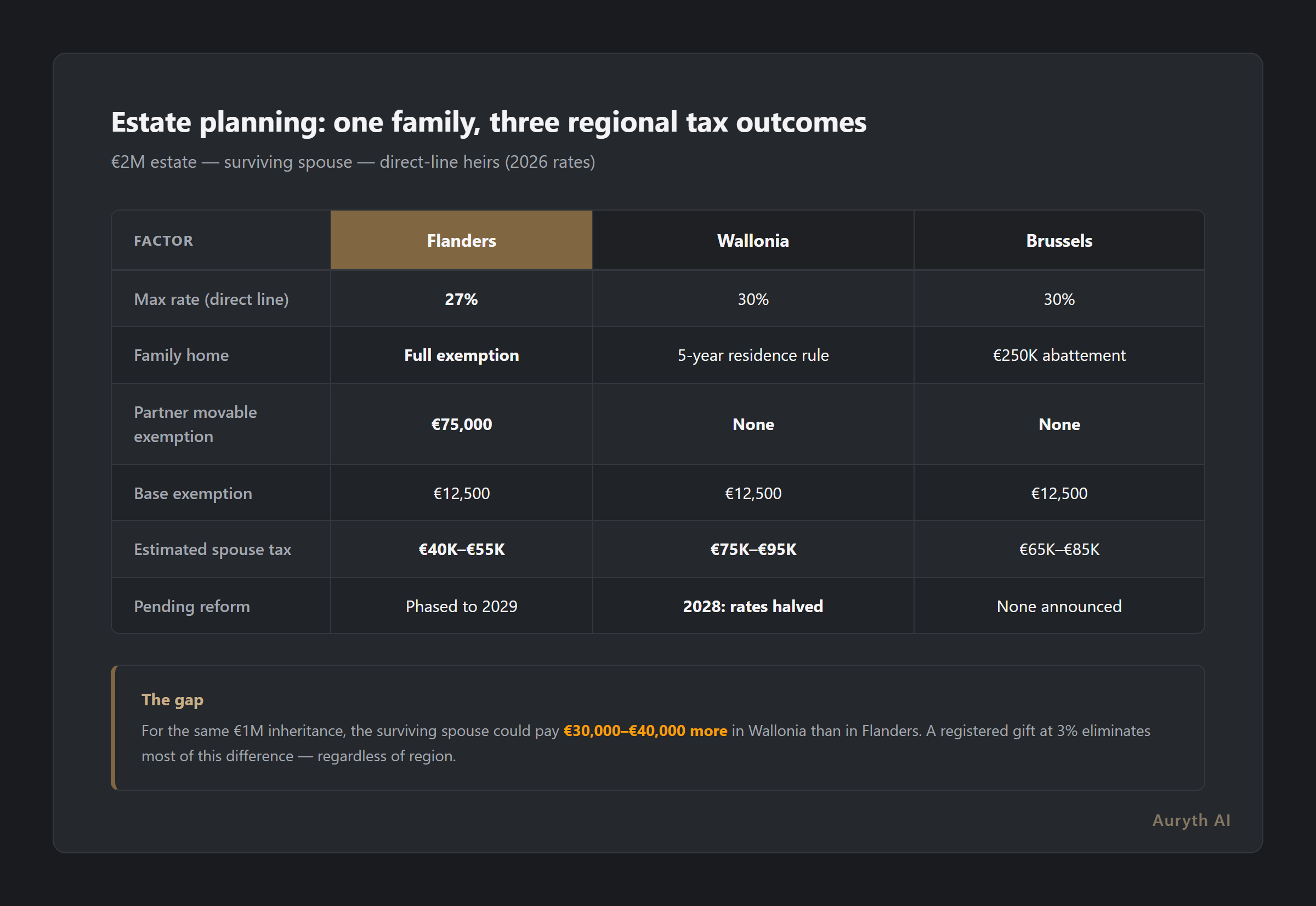

The three-region comparison

| Factor | Flanders (2026) | Wallonia (2026) | Brussels (2026) |

|---|---|---|---|

| Max rate (direct line) | 27% | 30% | 30% |

| Family home | Full exemption (spouse) | Exempt (5-year rule) | €250,000 abattement |

| Partner movable exemption | €75,000 | None | None |

| Base exemption | €12,500 | €12,500 | €12,500 |

| Estimated spouse tax | €40,000–€55,000 | €75,000–€95,000 | €65,000–€85,000 |

| Pending reform | Active (phased to 2029) | 2028 (rates halved) | None announced |

The gap: for the same €1M inheritance, the surviving spouse could pay roughly €30,000–€40,000 more in Wallonia than in Flanders. That difference alone exceeds many families’ annual savings.

The planning strategies that change the numbers

The baseline comparison shows the problem. But estate planning is about what happens before the baseline applies.

Strategy 1: registered gift of movable assets (schenking)

Marc and Sofie can donate their investment portfolio and savings to Lisa and Thomas during their lifetime.

Gift tax on movable property (all three regions):

- Direct line: 3% (Flanders and Brussels) or 3.3% (Wallonia)

- Others: 7% (Flanders and Brussels) or 5.5% (Wallonia)

On €500,000 in securities gifted to two children:

- Gift tax: €15,000 (3% × €500,000 in Flanders)

- Inheritance tax saved: potentially €100,000+ depending on the bracket

The gift must be registered. An unregistered gift (hand gift or bank transfer) carries zero gift tax — but if the donor dies within 5 years, the gifted amount is added back to the estate and taxed at inheritance tax rates (Art. 2.7.1.0.5 VCF in Flanders).

The 5-year lookback period was extended from 3 years on January 1, 2025 in Flanders and January 1, 2026 in Brussels. Wallonia already applied 5 years. Registering the gift eliminates this risk entirely.

Strategy 2: gesplitste aankoop (split purchase)

For real estate — like the Namur vacation apartment — a split purchase structure avoids inheritance tax on that property entirely.

How it works:

- Parents donate cash to children (3% gift tax on movable)

- Parents buy the usufruct, children buy the bare ownership — using the gifted funds

- When the parent dies, the usufruct expires automatically

- Children become full owners without inheritance tax on the property

For the De Smet family: if they had structured the Namur apartment (€250,000) this way, inheritance tax savings would be approximately €30,000–€60,000 depending on which child’s share and which bracket.

Warning: VLABEL (Flemish tax administration) has changed its position on split purchases multiple times. The structure must be executed correctly — specifically, the donation must predate the purchase, and the children must demonstrably use the donated funds.

Strategy 3: maatschap (société simple / einfache Gesellschaft)

For families with larger portfolios, a maatschap (civil partnership without legal personality) offers a powerful combination: transfer ownership while retaining control.

Structure:

- Marc and Sofie create a maatschap and contribute the investment portfolio

- They donate the shares to Lisa and Thomas (3% gift tax)

- Marc and Sofie remain statutory managers — retaining full control over investment decisions, distributions, and management

- The shares are no longer part of the estate upon death

Estate planning benefit: €800,000 in securities removed from the estate, with only €24,000 in gift tax (3%). Potential inheritance tax saved: €150,000+.

The maatschap is fiscally transparent — the children are taxed on their share of income, not the entity. And since the 2018 Companies Code reform, the administrative burden is minimal: no annual accounts required, no notarial deed needed for movable assets.

Strategy 4: the Walloon 2028 option

For families in Wallonia, the 2028 reform changes the calculation entirely:

| Factor | Wallonia 2026 | Wallonia 2028 |

|---|---|---|

| Max rate (direct line) | 30% | 15% |

| Family home (spouse) | 5-year residence rule | Residence rule eliminated |

| Siblings max | 65% | 33% |

| Others max | 80% | 40% |

A family currently paying €95,000 in Walloon inheritance tax might pay roughly €50,000 under the reformed rates — a savings that approaches Flanders’ current levels.

The advisory implication: for Walloon families with elderly parents in reasonable health, there is a genuine question of whether to implement aggressive planning now (gifts, maatschap) or wait for the 2028 reform to reduce the baseline. The answer depends on the donor’s age, health, and the size of the estate.

What makes this analysis difficult — and where AI changes the equation

The challenge is not that any single rate or exemption is hard to find. It is that the complete picture requires simultaneous cross-referencing of:

- Three regional rate tables (each with 6–9 brackets)

- Different exemption rules per region

- Different reform timelines (Flanders 2026–2029, Wallonia 2028, Brussels TBD)

- Interaction between gift tax and inheritance tax (3% now vs. 27% later)

- Planning instrument rules (gesplitste aankoop, maatschap, levensverzekering)

- The 5-year residence rule for determining the applicable region

An advisor doing this manually consults the Vlaamse Codex Fiscaliteit, the Walloon Code des droits de succession, and the Brussels fiscal code — three separate legal sources in two languages (Dutch and French). Cross-referencing a single planning question against all three takes an afternoon. Doing it for every client takes a career.

Common questions

Q: Does the region where I live determine my inheritance tax, or the region where the deceased lived?

A: The deceased’s fiscal domicile determines the applicable inheritance tax regime — specifically, the region where the deceased lived the longest during the five years before death. Your own region of residence as an heir is irrelevant for Belgian inheritance tax purposes.

Q: Can I reduce inheritance tax by moving to a different region?

A: In theory, yes — the 5-year rule means you would need to establish genuine fiscal domicile in the target region for more than 2.5 years of the 5-year lookback period. In practice, this requires an actual move, not just an address change. Tax authorities verify genuine residence.

Q: Is it better to gift assets now or wait?

A: For movable assets, a registered gift at 3% is almost always more tax-efficient than inheritance tax at 9–30%. The break-even is immediate: any amount above approximately €50,000 saves tax through gifting. The main consideration is whether you can afford to give up the assets — and whether you want to retain control (in which case, a maatschap structure may be appropriate).

Q: What happens to real estate in Wallonia if I live in Flanders?

A: The Flemish inheritance tax rates apply to the entire estate — including real estate located in Wallonia. The location of the property does not determine the tax rate; the deceased’s fiscal domicile does. This means Flemish rates (max 27%) apply even to the Namur apartment.

Related articles

- Three regions, three tax systems: why Belgian fiscal advice requires side-by-side comparison

- Case study: TAK 23 — why one product needs five tax answers

- What is temporal versioning — and why your legal AI tool probably serves you yesterday’s law

- How much time does tax AI actually save? An honest estimate

How Auryth TX applies this

When you ask Auryth TX about estate planning for a family like the De Smets, the system does not return a single region’s rates. It identifies that inheritance tax is regionally governed and builds a side-by-side comparison matrix — Flanders, Wallonia, and Brussels rates applied to the same estate, with the applicable region highlighted based on the deceased’s fiscal domicile.

The analysis goes beyond rates. It maps the interaction between planning strategies (gift, maatschap, split purchase) and each region’s specific rules — including reform timelines. When Wallonia’s 2028 reform takes effect, the comparison updates automatically. When Flanders adjusts its phased brackets, the matrix reflects it.

Critically, the system flags what an advisor should consider before answering: which region applies, whether the 5-year rule is clear, whether pending reforms change the calculus, and which planning instruments are available. The structured output shows each variable separately — rates, exemptions, reform status, planning options — so the advisor can build a complete recommendation instead of answering a fragment.

One family. Three regions. Every rate, exemption, and planning strategy compared in one analysis.

Sources: 1. Vlaamse Codex Fiscaliteit — Art. 2.7.1.0.5 (gift lookback), Art. 2.7.3.2.1 (rates). vlaanderen.be. 2. FOD Financiën. “Successierechten — betaling en tarieven.” fin.belgium.be. 3. Notaire.be (2024). “Réforme en Wallonie des droits de succession et de donations immobilières.” 4. Jubel (2025). “Verlaging Vlaamse erfbelasting vanaf 2026.” 5. PwC Belgium (2025). “Important changes in Flemish registration duties and inheritance tax.” 6. RGF (2024). “Inheritance tax in Wallonia: what changes will the reform bring?” 7. ICLG (2025). “Private Client Laws and Regulations — Belgium.”