Case study: TAK 23 — why one product needs five tax answers

A single TAK 23 life insurance product touches insurance tax, income tax, withholding tax, TOB, and regional inheritance tax. Here's what most advisors — and every AI chatbot — miss.

By Auryth Team

A client asks about the tax implications of a TAK 23 investment. You give a solid answer on the income tax side. You mention the insurance premium tax. Then, three months later, the client’s notary calls about the inheritance tax implications — in a different region than you assumed. You didn’t miss anything you knew about. You missed what you didn’t think to look for.

This is not a hypothetical. This is the structural challenge of any product that crosses multiple Belgian tax domains simultaneously.

What makes TAK 23 the perfect stress test

TAK 23 (Branch 23) is a unit-linked life insurance product where premiums are invested in internal funds — shares, bonds, real estate, or mixed portfolios. The policyholder bears the investment risk. There is no capital guarantee.

As a financial product, it is straightforward. As a tax question, it is anything but.

A single TAK 23 contract can touch at least five distinct tax regimes — each governed by different legislation, different authorities, and in some cases different levels of government. Miss one domain and your advice is incomplete. Miss a regional variation and it may be wrong.

A TAK 23 question is never one question. It is at least five.

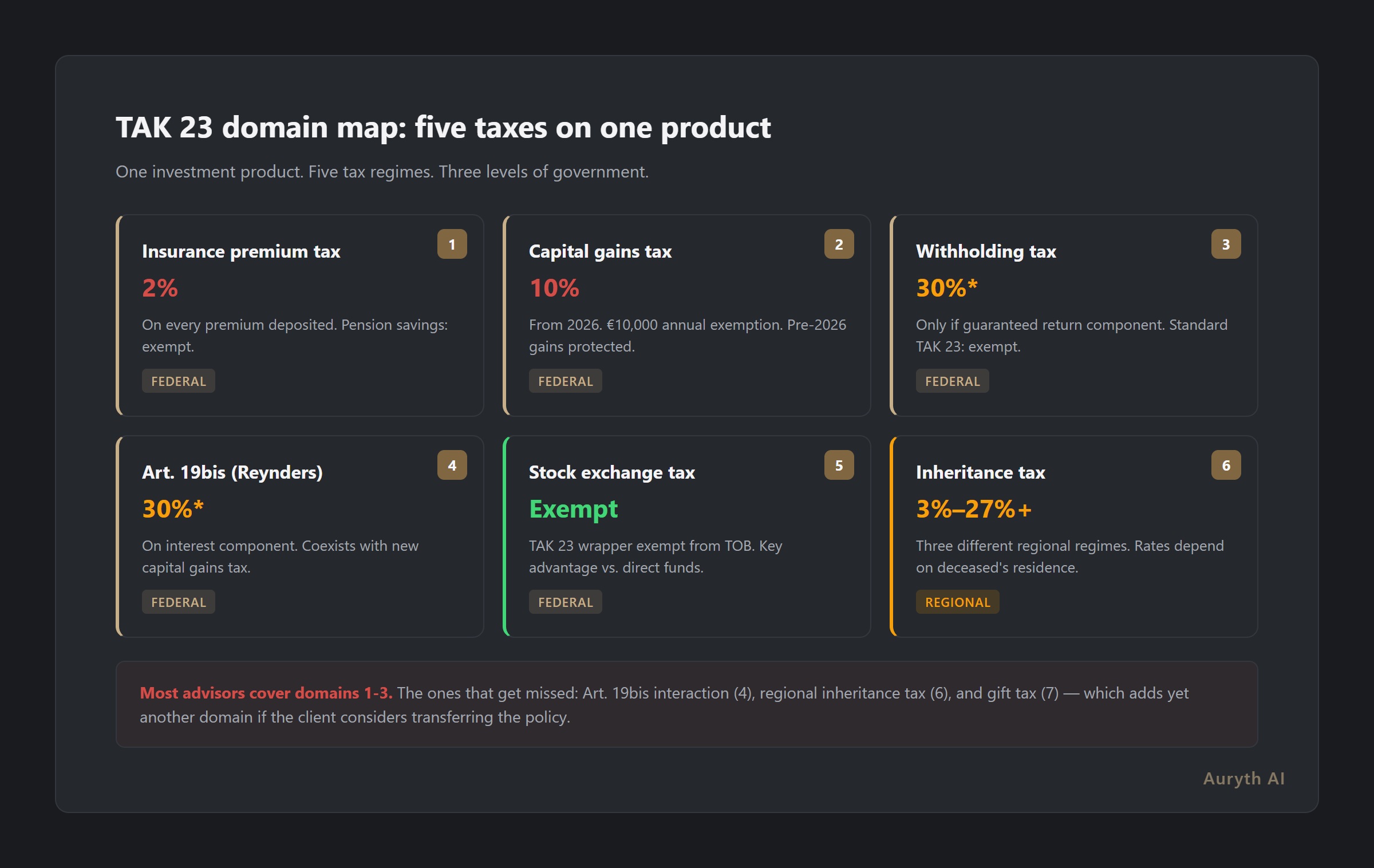

The domain map: five taxes on one product

| Domain | Tax | Rate | Authority | Key rule |

|---|---|---|---|---|

| Insurance premium tax | Verzekeringsbelasting | 2% on each premium | Federal (FOD Financiën) | Applies to every TAK 23 deposit. Exception: pension savings premiums are exempt |

| Capital gains tax | Meerwaardebelasting (from 2026) | 10% on realized gains | Federal | Annual exemption of €10,000 per taxpayer. Acquisition value for pre-2026 contracts = December 31, 2025 value |

| Withholding tax | Roerende voorheffing | 30% (conditional) | Federal | Only applies if product includes guaranteed return component. Standard TAK 23 without guarantees: exempt |

| TOB | Taks op beursverrichtingen | Exempt | Federal | TAK 23 wrapper is exempt from stock exchange tax — a key advantage over direct fund investment |

| Inheritance tax | Erfbelasting / Droits de succession | 3%–27%+ (varies) | Regional (Flanders/Wallonia/Brussels) | Rates depend on deceased’s tax residence. Three completely different regimes |

Five domains. Three levels of authority. And this table only covers the standard case — if the client also considers gifting the policy, gift tax adds a sixth domain with its own regional variations.

Where generic AI fails — and why

Ask ChatGPT “what are the tax implications of TAK 23 in Belgium?” and you will get a response. It will likely mention the 2% premium tax and possibly the withholding tax rules. It may even reference Art. 19bis WIB.

What it will not do:

- Flag what it doesn’t cover. Generic AI has no mechanism for negative retrieval — identifying which relevant domains it has not addressed

- Handle regional variation. There is no single “Belgian inheritance tax rate.” The answer depends entirely on which region — and the rates are diverging further in 2026-2029

- Account for 2026 legislative changes. The introduction of a 10% capital gains tax fundamentally alters TAK 23’s tax profile. Most AI models lack access to pending or recently enacted legislation

- Show the interaction between domains. Art. 19bis WIB (the Reynders tax on the interest component) coexists with the new capital gains tax — creating a split-rate scenario where different parts of the same return are taxed at different rates

The failure is not that AI gives wrong answers about TAK 23. It is that AI gives incomplete answers and presents them as complete.

The 2026 shift: why this matters now

Before 2026, TAK 23 enjoyed near-total exemption from investment income taxation. The 2% insurance premium tax was the primary cost. This was a key selling point — and a major reason financial advisors recommended the TAK 23 wrapper over direct fund investment.

The introduction of a general capital gains tax changes this calculus fundamentally:

| Aspect | Before 2026 | From 2026 |

|---|---|---|

| Premium tax | 2% | 2% (unchanged) |

| Capital gains | Not taxed | 10% on realized gains (€10,000 annual exemption) |

| Art. 19bis | 30% on interest component | Continues alongside capital gains tax |

| TOB | Exempt | Exempt (unchanged — still an advantage) |

| Overall profile | Tax-efficient wrapper | Requires case-by-case comparison with alternatives |

The question “is TAK 23 still tax-efficient?” no longer has a generic answer. It depends on the investment horizon, the fund composition, the annual return, whether the client is in Flanders or Wallonia, and whether estate planning is part of the picture.

This is exactly the type of question where cross-domain analysis matters more than any single-domain answer.

The regional inheritance tax problem

The most commonly overlooked domain in TAK 23 advice is inheritance tax — because it is governed by regional law, not federal.

Flanders, Wallonia, and Brussels each have their own inheritance tax regime. These are not minor variations. They are fundamentally different systems with different rates, exemptions, and reform timelines:

- Flanders (from 2026): New reduced rates for direct-line heirs — €50,000 tax-free, 3% on €50,000–€150,000, 9% on €150,000–€250,000, 27% above €250,000. Phased implementation through 2029

- Wallonia (from 2028): Rates halved in direct line, moving toward a 15% maximum

- Brussels: Progressive rates from 3% to 30% for direct-line heirs, with a €12,500 base exemption and reduced rates for the family home

A TAK 23 advice that mentions “inheritance tax” without specifying the region is not incomplete. It is wrong — because the “rate” depends entirely on where the deceased was fiscally resident. And clients move between regions.

What a domain radar catches

The concept is simple: before answering any tax question, systematically map every domain the product touches. Not just the domain the client asked about — every domain that applies.

For TAK 23, a systematic domain radar would flag:

- Insurance premium tax — always applicable (2%)

- Capital gains tax — applicable from 2026 (10%, with exemption)

- Withholding tax — check for guaranteed return components (30% if yes)

- Art. 19bis — check for interest component in underlying funds (30%)

- TOB — confirm exemption (exempt for TAK 23 wrapper)

- Inheritance tax — identify client’s region of tax residence

- Gift tax — relevant if client considers transferring the policy (3% or 7% depending on relationship)

Most advisors cover domains 1-3 by default. The ones that get missed are 4 (the Art. 19bis interaction), 6 (regional inheritance tax), and 7 (gift tax).

The difference between good advice and complete advice is systematic coverage — not deeper expertise in any single domain.

Related articles

- What is authority ranking — and why your legal AI tool probably ignores it →

- What is confidence scoring — and why it’s more honest than a confident answer →

- 5 Belgian tax questions where generic AI is guaranteed to fail →

How Auryth TX applies this

When you ask Auryth TX about TAK 23, the system does not answer a single question. It runs a domain radar across the entire Belgian legal corpus — federal tax law, regional tax codes, insurance regulation, and relevant case law — to identify every domain the product touches.

The structured output shows each applicable domain separately: the relevant legal basis, the current rate, the conditions for applicability, and the confidence level for each domain. Where regional variation exists, the system flags it explicitly and asks which region applies before providing rates.

Critically, the system also performs negative retrieval — identifying domains it searched but found no relevant results for, or domains where its confidence is low. An incomplete answer labeled as incomplete is infinitely more useful than a partial answer presented as complete.

TAK 23 is onze lakmoesproef. Als wij dit correct kunnen, kunnen wij alles.

Sources: 1. FSMA. “Class 23 life insurance.” fsma.be. 2. FOD Financiën. Taks op beursverrichtingen — officiële regelgeving. financien.belgium.be. 3. Tiberghien (2025). “Nieuwe meerwaardebelasting krijgt vorm — en Reynders-taks verrijst uit zijn as.” 4. Nagelmackers (2026). “Nieuwe Belgische meerwaardebelasting: wat u moet weten.” 5. Test Aankoop (2025). “Veranderingen successierechten 2026.”