Three regions, three tax systems: why Belgian fiscal advice requires side-by-side comparison

Belgium has three inheritance tax regimes, three gift tax structures, and three registration duty rates — each with different reform timelines. Here's what that means for advisors and why no single answer is ever complete.

By Auryth Team

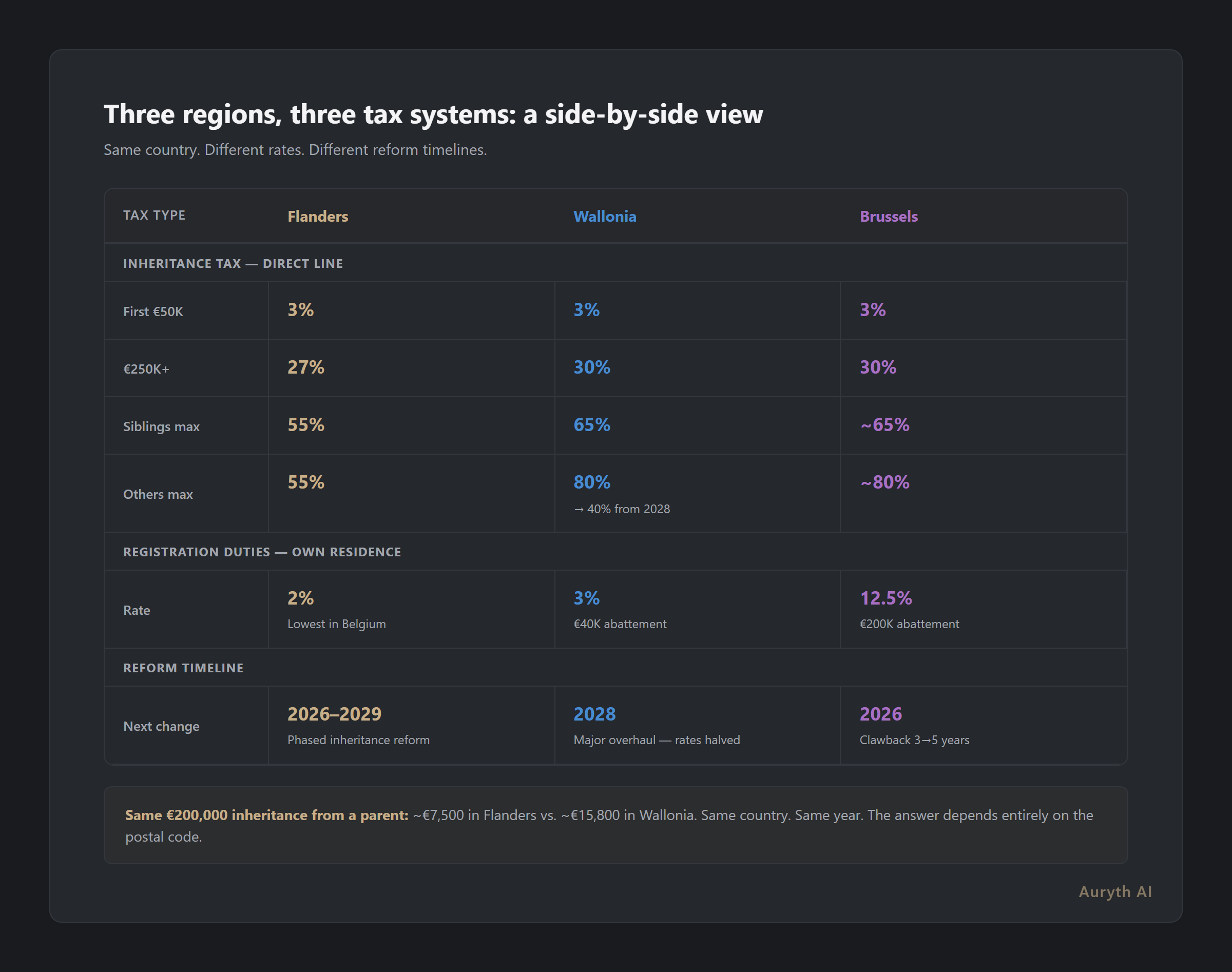

A client in Antwerp inherits €200,000 from a parent. Inheritance tax: approximately €7,500 under Flanders’ reformed 2026 rates. The same inheritance, same relationship, same amount — but from a parent in Liège: approximately €15,800 under Wallonia’s current rates. Same country. Same year. Double the tax.

This is not an edge case. This is the baseline reality of Belgian fiscal advice.

Three regions, three systems

Belgium does not have a single inheritance tax, a single gift tax, or a single registration duty rate. It has three of each — one per region.

- Flanders (Vlaamse Codex Fiscaliteit, administered by the Vlaamse Belastingdienst)

- Wallonia (Code wallon, administered by the federal FPS Finance)

- Brussels (Brussels tax code, administered by the federal FPS Finance)

These are not minor variations on a shared framework. They are fundamentally different systems with different rates, different brackets, different exemptions, and — critically — different reform timelines.

In Belgium, the question “what is the inheritance tax rate?” has no answer without a postal code.

Inheritance tax: the starkest divergence

Inheritance tax is the most regionalized tax in Belgium. The region that applies is determined by the deceased’s last tax residence — specifically, the region where they lived the longest during the last five years of their life.

Direct line (spouse, children, parents) — 2026 rates

| Bracket | Flanders | Wallonia | Brussels |

|---|---|---|---|

| First €50,000 | 0% (tax-free) | 3% | 3% |

| €50,001–€100,000 | 3% | 5–10% | 8% |

| €100,001–€175,000 | 3%/9%* | 10–14% | 9% |

| €175,001–€250,000 | 9% | 14–18% | 18% |

| €250,001–€500,000 | 27% | 24–30% | 24% |

| €500,000+ | 27% | 30% | 30% |

Key exemptions differ fundamentally:

Flanders brackets differ: 3% applies up to €150,000, 9% from €150,001 to €250,000.

- Flanders: Surviving partner gets €75,000 exemption on movable assets (increased from €50,000 on January 1, 2026). Family home is fully exempt for surviving spouse or legal cohabitant.

- Wallonia: €12,500 base exemption, rising to €25,000 if net share is below €125,000. Children under 21 get an additional €2,500 per year until age 21.

- Brussels: €12,500 base exemption. Family home reduced rate up to €250,000 for direct heirs. Full exemption for surviving spouse.

Siblings and others — the gap widens

For non-direct-line heirs, the differences become extreme:

| Relationship | Flanders max | Wallonia max | Brussels max |

|---|---|---|---|

| Siblings | 55% | 65% | ~65% |

| Others (no family tie) | 55% | 80% | ~80% |

In Wallonia, a distant relative can currently face an 80% marginal rate on larger inheritances. In Flanders, the maximum is 55%. This is not a rounding difference — it is a fundamentally different policy philosophy.

Gift tax: apparent simplicity hides real complexity

For movable property (money, securities, art), all three regions apply the same flat rates: 3% for direct line, 7% for others. This is one of the few areas of uniformity.

For real estate gifts, however, the rates diverge sharply:

| Region | Direct line (max) | Others (max) |

|---|---|---|

| Flanders | 3–40% progressive | Up to 40% |

| Wallonia | 3–18% (→ halved in 2028) | 27% (→ 14% in 2028) |

| Brussels | 3–27% progressive | Higher progressive rates |

The clawback period — how long a gift counts toward the estate if the donor dies — also varies:

- Flanders: 5 years (extended from 3 years on January 1, 2025)

- Wallonia: 5 years

- Brussels: 5 years (extended from 3 years on January 1, 2026)

Advising a client on whether to register a gift requires knowing not just the gift tax rates in their region, but also the inheritance tax rates — because the decision depends on the comparison between the two. And both differ by region.

Registration duties: three different entry costs

When buying real estate, the registration duty depends on the region where the property is located:

| Region | Own residence | Other property | Key benefit |

|---|---|---|---|

| Flanders | 2% | 12% | Lowest rate for first home |

| Wallonia | 3% | 12.5% | Reduced rate replaced former abattement system |

| Brussels | 12.5% (with abattement) | 12.5% | €200,000 tax-free abattement |

A first-time buyer purchasing a €400,000 home pays:

- In Flanders: €8,000 (2% on full price)

- In Wallonia: €12,000 (3% on €400,000)

- In Brussels: €25,000 (12.5% on €400,000 minus €200,000 abattement)

The Brussels abattement is generous in absolute terms (€200,000 tax-free), but the base rate of 12.5% makes it significantly more expensive for properties above that threshold.

Property tax: where municipal surcharges change everything

The base property tax (onroerende voorheffing / précompte immobilier) rate differs between regions:

| Region | Base rate |

|---|---|

| Flanders | 2.5% of indexed cadastral income |

| Wallonia | 1.25% of indexed cadastral income |

| Brussels | 1.25% of indexed cadastral income |

But the base rate tells almost nothing. Municipal surcharges (opcentiemen / centimes additionnels) range from 18% to over 50%, and they vary by individual municipality — not just by region.

Average effective rates paint a counterintuitive picture:

- Flanders: ~46% of cadastral income

- Wallonia: ~55% of cadastral income

- Brussels: ~55% of cadastral income

Despite having the lowest base rate, Wallonia and Brussels end up with higher effective property tax due to higher municipal surcharges. A client comparing properties across regions needs municipality-level data, not just regional rates.

The reform timeline problem

The three regions are not just different — they are diverging on different schedules.

| Year | Flanders | Wallonia | Brussels |

|---|---|---|---|

| 2025 | Gift clawback: 3→5 years. Registration duty for own residence: 3%→2% | — | — |

| 2026 | Inheritance tax reform begins. Partner exemption: €50K→€75K. New single deduction. | — | Gift clawback: 3→5 years |

| 2028 | Reform continues (phased brackets) | Major reform: inheritance tax halved in direct line (max 15%). Gift tax on real estate halved. | — |

| 2029 | Full reform implementation | — | — |

An advisor answering a question about estate planning in February 2026 must simultaneously track:

- Flanders’ phased reform (already active, completing in 2029)

- Wallonia’s upcoming overhaul (not yet active, takes effect in 2028)

- Brussels’ incremental change (clawback period extended in 2026)

This is temporal versioning and regional comparison combined — the most complex intersection in Belgian fiscal advice.

Why this matters for advisors

The practical impact is straightforward: every regionalized tax question is actually three questions.

A client asks about inheritance planning. The advisor must determine:

- Which region applies (based on current or planned tax residence)

- What the current rates are in that region

- Whether reforms are pending that will change those rates

- How the rates compare to alternative regions (relevant if the client is considering relocation)

- Whether the gift tax alternative is more favorable (which also differs by region)

Doing this manually means consulting three different legal codes, cross-referencing reform timelines, and building comparison tables by hand. It takes time. It introduces error. And it changes every time a region passes new legislation.

The daily reality for Belgian tax professionals: no single source provides a side-by-side comparison of all three regions’ rules for a given tax type. The information exists — spread across the Vlaamse Codex Fiscaliteit, the Code wallon, and Brussels’ tax code — but assembling it is manual work.

Related articles

- Case study: TAK 23 — why one product needs five tax answers →

- What is temporal versioning — and why your legal AI tool probably serves you yesterday’s law →

- What is authority ranking — and why your legal AI tool probably ignores it →

How Auryth TX applies this

When you ask Auryth TX a question that involves a regionalized tax, the system does not return a single answer. It identifies that the tax is regionally governed and presents a side-by-side comparison across all three regions — with the correct rates, exemptions, and conditions for each.

The comparison is not static. Each rate is linked to its source in the relevant regional code, carries its effective date, and indicates whether a reform is pending. When Flanders’ phased inheritance tax reform updates a bracket, the comparison table reflects it immediately — while showing that Wallonia’s rates remain unchanged until 2028.

If the client’s region is known, the system highlights the applicable column. If the client is considering relocation or has assets in multiple regions, the full comparison becomes the answer.

One question. Three regions. All rates, exemptions, and conditions side by side.

Sources: 1. FPS Finance. “Inheritance tax and estate duties.” fin.belgium.be. 2. CMS Law-Now (2024). “Belgium’s regions pass new registration and inheritance tax rates.” 3. KPMG (2024). “Overview of agreed tax measures for Flemish region.” 4. Notaire.be (2024). “Réforme en Wallonie des droits de succession et de donations immobilières.” 5. PwC Tax Summaries. “Belgium — Individual — Other taxes.” taxsummaries.pwc.com. 6. Vlaanderen.be. “Gift tax.” vlaanderen.be/en.